Construction material supply and price issues

Construction material supply and price volatility is at record levels. It seems like every day we are being notified of forced significant changes in material price and significant delays on delivery.

Why is this happening?

Our federal counterparts, the Canadian Construction Association, explain that the current situation is a result of a perfect storm of factors, including:

1) The decision by the Quebec provincial government to shut down the province’s economy last March, including the supply and manufacturing industries, caused some companies (e.g. lumber) to sell their inventory to the US, particularly since economic activity in other provinces was also slowing down. This led to a shortage of materials into the fall of 2020 and seems to be continuing today .

2) COVID-19 brought new requirements to worksites and production lines, including social distancing, enhanced cleaning protocols, and limiting the number of people allowed on sites. These requirements, while necessary, had a huge impact on productivity which led to a reduction in materials produced well into the fall of 2020.

3) Under the Trump administration, the US industry did not slow down at all as no extraordinary measures were taken to reduce the spread of the virus, which accentuated the demand for Canadian products.

4) Prior to COVID-19 being declared a pandemic, the Port of Montreal was hit by a long strike that paralyzed the port for many weeks and massively disrupted the supply chain.

5) Softwood production continues to be disrupted in British Columbia and Alberta due to a pine beetle infestation since 2017.

6) During the first two waves of the pandemic, many Canadians chose to start their own personal home improvement projects, which increased demand for construction materials and again added to the supply crisis, leading to escalating costs.

How bad is it?

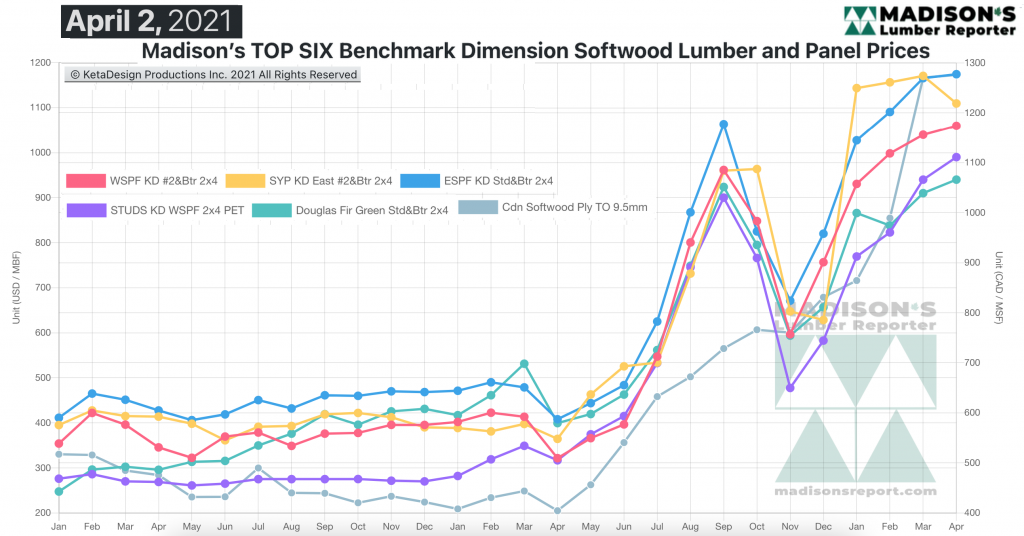

As you know, the result has been significant price increases for many fundamental building supplies and delays in shipping. Based on the most recent market update provided by Madison’s Lumber Reporter, the benchmark price for softwood lumber is triple that of the price in February of last year.

Madison’s also reports significant wait times for lumber deliveries. If you see lumber in a lumberyard, it most likely is already sold! Below is a graph outlining the price changes since January 2019. It clearly shows prices stability between January 2019 to March 2020, followed by significant price changes starting July of last year.

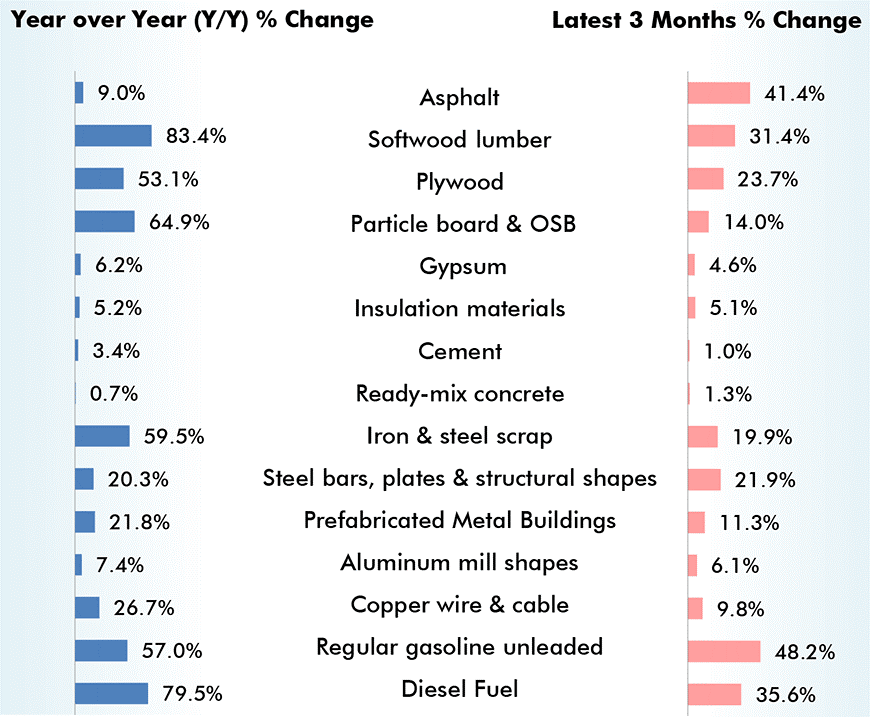

Lumber isn’t the only construction material experiencing price changes. Below is a graph based on the U.S. Producer Price Index as of March 2021. In addition of fuel and lumber, the significant movers have been iron and steel. The PPI is not reporting major changes in gypsum yet, but we are hearing reports of tight supply.

Table 1: U.S. Construction Material Cost Changes

From Producer Price Index (PPI) Series – March 2021

What can I do to protect myself and my business?

It’s impossible to be certain how long these price surges will last, but it’s reasonable to expect them to continue into 2022. While WCA doesn’t have a secret supplier of lumber or steel that can get you materials at a reasonable price, we can offer you something that will help – strategies on how to use construction contracts to mitigate the risk of rising prices and supply chain issues.

WCA is hosting a free information session on Using Contracts to Manage the Risk of Price Volatility on May 13 from 11:30 – 12:30. More information and registration (once again, this is a free session) available here.